Account & Session Takeover Prevention

Account Takeovers and Fraud Harm End Users and Your Reputation

Account takeovers and related fraud continue to challenge many of the world’s top brands. The rise of infostealer malware has only made things worse. Cybercriminals are now harvesting and selling passwords, session cookies, browser data, and more on the dark web — fueling a steady stream of exploitable data.

Each month, thousands of end-user accounts from social media, entertainment, streaming, and e-commerce platforms are compromised. The downstream impact? Millions of dollars in losses.

Gain Actionable Alerts when Threat Actors Compromise End Users’ Accounts

Understand the ROI of Being Proactive with Flare ASTP

The Flare ASTP ROI calculator will help you understand how many users have exposed accounts on average, how costly those exposures are, and what ROI you can expect in being proactive.

to session hijacking

How Leading Companies Prevent Account Takeovers

How Flare Helps Prevent ATO

Best-In-Class Identity Intelligence

Robust APIs and Integrations

AI Powered Dark Web Analysis

Complete Data Transparency

Account Takeover Prevention Industry Use Cases

Start a Free TrialE-Commerce & Retail

Social Media

Entertainment

Finance

ATO FAQs

What is Flare Account and Session Takeover Prevention (ASTP)?

Flare ASTP is an API product that enables web app and fraud security teams to connect to Flare’s world-class stealer log collection operation and database to identify compromised accounts and sessions among their users.

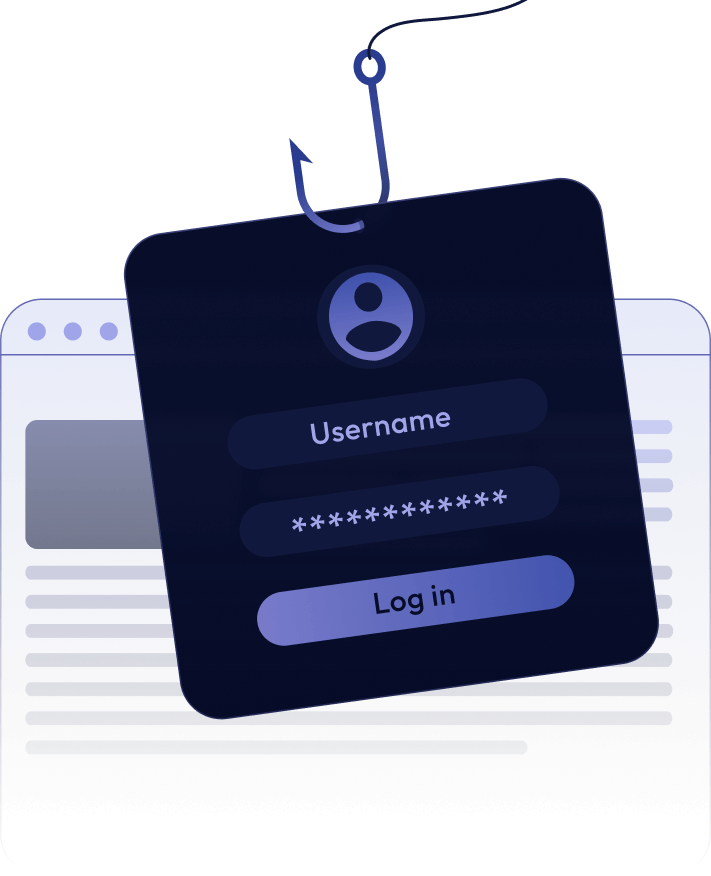

Why is session hijacking of end user accounts a problem?

Session cookies are particularly valuable to attackers because they allow them to bypass authentication entirely, including multi-factor authentication (MFA). In other words, with a stolen session cookie, attackers can maintain access to an account without needing the user’s credentials. Once an end user’s account has been taken over, cyber criminals can monetize access and commit fraud in a variety of ways.

How is it different from other methods of ATO prevention?

There are several strategies and vendor solutions available to combat ATO. Many solutions include behavioral analytics, payment fraud detection, and content integrity. However, Flare fills a critical gap by addressing the threat posed by stolen session cookies which has quickly become “the path of least resistance” for cybercriminals to take over accounts.

What do I need to implement for Flare Account and Session Takeover Prevention?

To effectively act on the data provided by Flare, customers need to have mechanisms to verify a cookie’s validity and revoke compromised cookies to mitigate the risk of account takeover.