How are Canadian Fraudsters Taking Advantage of the COVID-19 Pandemic?

When disasters hit, fraudsters are usually quick to take advantage of the situation and especially of the most vulnerable. The COVID-19 pandemic appears to trigger many types of fraud converging into a pattern that has become all too familiar. Recently, the Canadian Anti-Fraud Centre issued a warning regarding COVID-19 related fraud methods.

Our investigation demonstrates that fraudsters are:

1) targeting the relief programs to defraud out-of-work individuals;

2) using current economic conditions resulting from the COVID-19 crisis as recruitment and marketing tools

Our findings confirm what we have shown before: that fraudsters are excellent marketers who know how to take advantage of a crisis.

Targeting relief programs

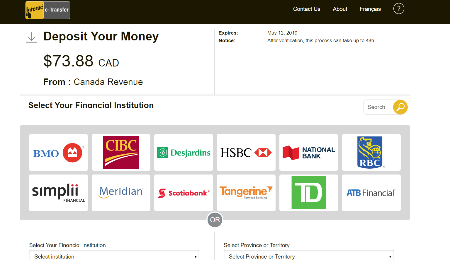

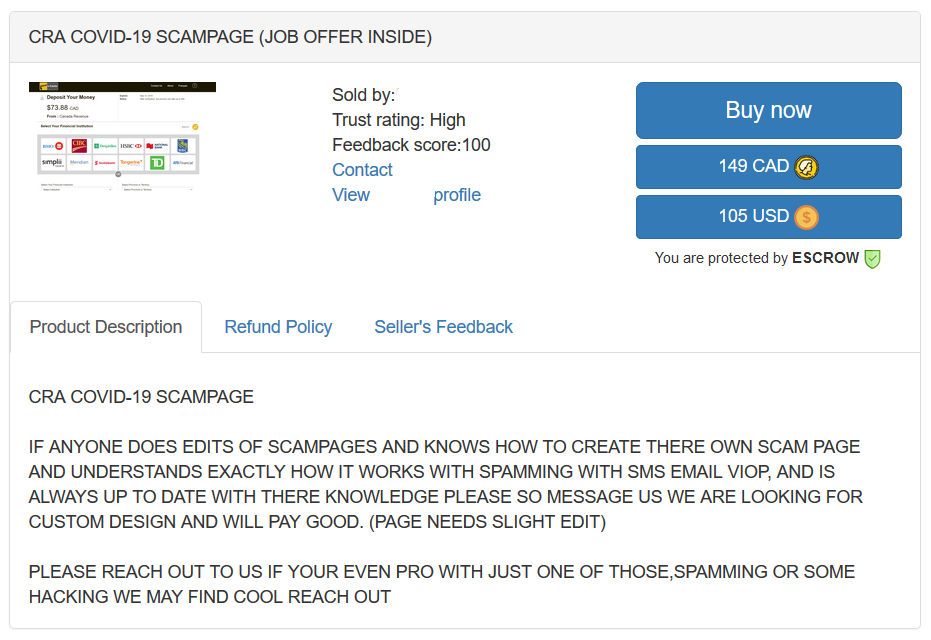

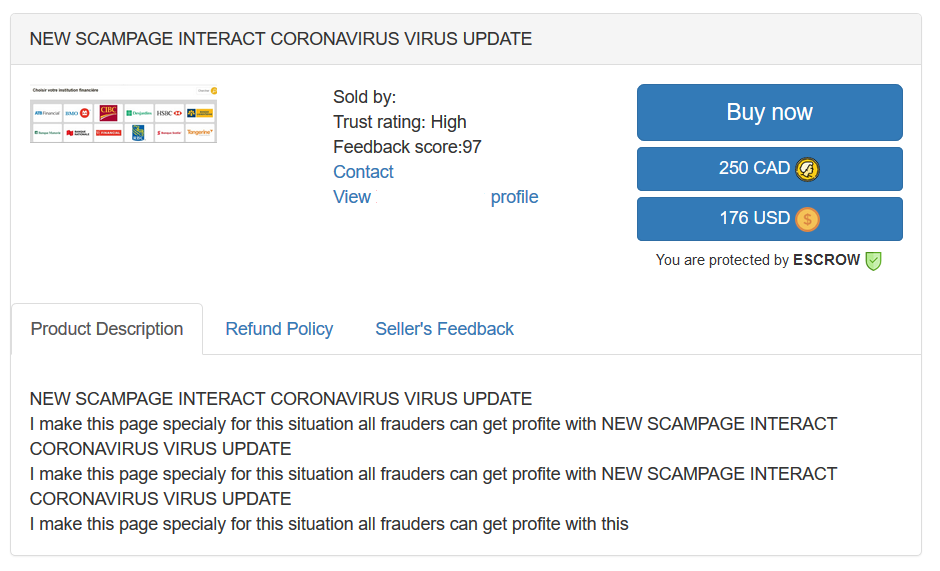

Advertisements are explicitly offering scam pages that mimic Interac transfer. Fraudsters are contacting their victims by Email or SMS and are inviting them to click on a link to accept a payment from the Canada Revenue Agency (CRA). On the phishing site, victims enter their bank logins, which are then siphoned off and sold by fraudsters. These methods are working as demonstrated by multiple positive reviews. Fraudsters that target relief programs also have an established track record with over a hundred positive feedback comments. See screenshots from two advertisements on one of the darkweb forums.

Recruiting and marketing their existing tools

Fraudsters are using the COVID-19 pandemic to offer their services as a means to generate revenues. Fraudsters are recruiting newcomers with the promise to improve skills of the new entrants in the fraud market.

Don’t let coronavirus break your jugg. Get some money like a god. I’ll be there to assist you at anytime if you don’t know what to do with a paypal account!

~

I will also offer some tips for the buyer so they can cash out instantly no waiting around !! I only have this one so first come first serve !! Dont miss out !! Make the best of this corona virus while times are tough!!

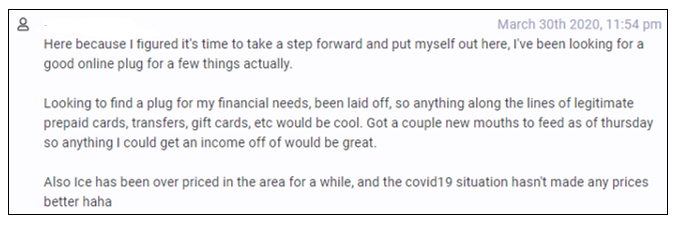

These calls to actions seem to resonate with a certain population as demonstrated in the post below.

An individual identifies a criminal opportunity and shows interest in taking advantage of it because he/she is laid off. This suggests that a higher number of fraud incidents are to be expected in the coming weeks as new fraudsters experiment with the methods for sale on the darkweb.

How to protect against the changing fraud landscape

The costs of fraud methods are constantly increasing and the pandemic is but a new opportunity to further increase illicit gains. To protect yourself against the changing fraud landscape, we recommend that you alert your customers and employees about the scams targeting relief programs. They should know that CRA will not be contacting them via Email and SMS to send Interac e-transfers. CRA has a secure dashboard where it communicates with people directly. Moreover, CRA will not be sending Interac e-transfers as a method of payment.

A great resource to educate your customers and employees is Brian Kreb’s basic rules for online safety. It reminds everyone that they should be extremely critical of the information they receive without actively going out to seek it.

As email is an important method to connect with victims, you should ensure that your spam email filters closely monitor all communications that include keywords associated with COVID-19, CORONAVIRUS, RELIEF and CRA (Canada Revenue Agency).